Five Key Highlights for Business and Investment of Vietnam’s Economic Q1 2025

Vietnam’s economy has kicked off 2025 with strong momentum, showcasing positive signs across key sectors. Based on recent data and government reports, here are five notable highlights from Vietnam’s Q1 2025 economic performance, offering insights for businesses, investors, and global partners:

1. Institutional Reform & Trade Policy Adaptability

Vietnam’s government continues to push forward with institutional reform, streamlining administrative structures under a two-tier local governance model. Alongside domestic restructuring, Vietnam is proactively responding to U.S. tariff policies, reducing import duties on 23 product groups and initiating trade negotiations to mitigate retaliatory tariffs. These strategic moves aim to maintain macroeconomic stability and enhance global trade resilience.

2. Strong GDP Growth – Highest Q1 Performance in Six Years

Vietnam’s GDP in Q1 2025 grew by 6.93%, the highest for a first quarter in six years. Growth was mainly driven by manufacturing and processing industries, services, and a significant rebound in agriculture. On the demand side, final consumption and investment saw impressive increases, while exports and trade surplus also improved.

3. Inflation Under Control Amid Rising Demand

Despite rising consumer demand and cost-push pressures, Vietnam kept average inflation (CPI) at 3.22% in Q1. Core inflation rose by 3.01%, still within safe limits. This reflects the government’s effective coordination of monetary and fiscal policies, ensuring stable prices in the face of global volatility.

4. Stable Interest Rates, Credit Growth, and FX Rates

Lending interest rates slightly decreased, supporting business access to capital. Credit growth reached 3.5%, reflecting recovery in consumption, investment, and real estate. The interbank exchange rate rose moderately by 2.1%, remaining under control thanks to strong foreign currency reserves and sustained FDI inflows.

5. State Budget Revenue Rises on Production and Trade Recovery

State budget revenue in Q1 reached 36.7% of the annual target, up 29.3% YoY. This reflects stronger industrial output, retail recovery, and export-import activities. However, public investment disbursement remains uneven, signaling a need for faster public capital mobilization to maintain growth momentum.

What Does This Mean for Businesses and Investors?

With solid fundamentals, Vietnam remains a promising destination for investment and business expansion in 2025. However, attention must be given to external risks such as global geopolitical tensions, U.S. trade measures, and rising debt risks. For investors and international partners, now is the time to closely follow Vietnam’s policy developments and market signals.

Stay updated with our insights on Vietnam’s economy and business trends – helping you make smarter, faster, and future-proof decisions.

Other Articles

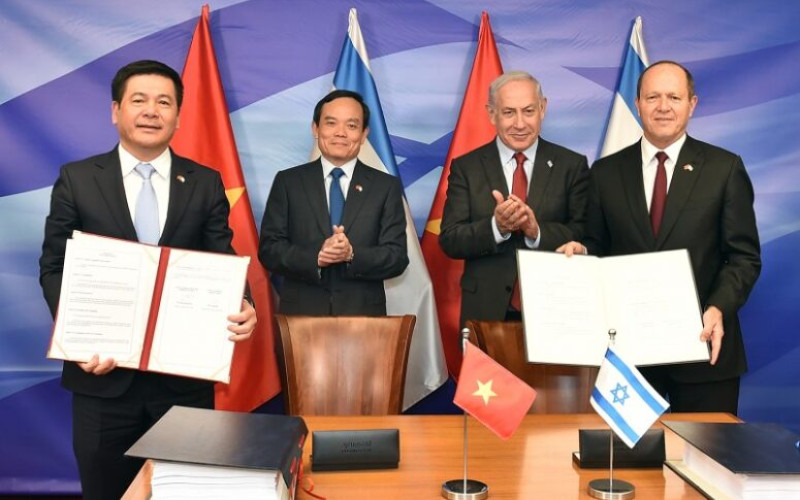

Vietnam’s Free Trade Agreements 2025

26/03/2025

10 Booming Industries in 2030

26/03/2025