Government of Vietnam agrees to VAT cut of 2% in 1H 2024

Reductions to take effect from January 1 until June 30.

Value-added tax (VAT) rates on most goods and services will be cut by 2% from January 1, under a new Decree from the government, the Government News has reported.

The 2 per cent reduction will be applicable to products and services subject to a 10 per cent rate, with exceptions for three groups of products and services, as follows.

Group 1: Telecommunications, financial activities, banking, securities, insurance, real estate business, metals and prefabricated products, mining products (excluding coal mining), coke coal, refined petroleum, and chemical products.

Group 2: Goods and services subject to special consumption taxes.

Group 3: Information technology under information technology laws.

The VAT reduction will be applied to all stages, including import, manufacturing, processing and trading.

The Decree will be in effect from January 1 to June 30, 2024.

Source: Vneconomy.vn

Other Articles

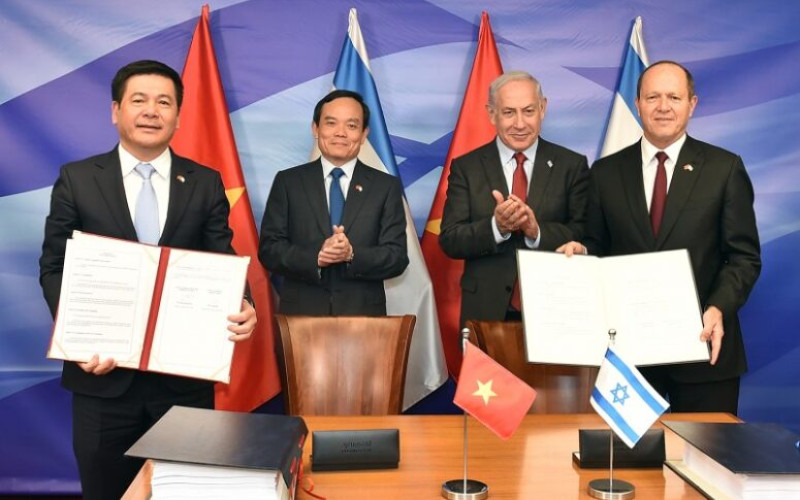

Vietnam’s Free Trade Agreements 2025

26/03/2025

10 Booming Industries in 2030

26/03/2025

Vietnam’s Renewable Energy Industry

26/03/2025

The Challenges Of Hiring Expats In Vietnam

26/03/2025

Key Employee Retention

10/03/2025