SWOT Analysis – Vietnam Industrial Manufacturing Sector (2025)

14/04/2025

Strengths

- Competitive labor cost: Despite rising wages, Vietnam remains cheaper than some countries in ASEAN.

- Strategic location: Proximity to ASEAN, and major shipping routes makes it ideal for manufacturing and export.

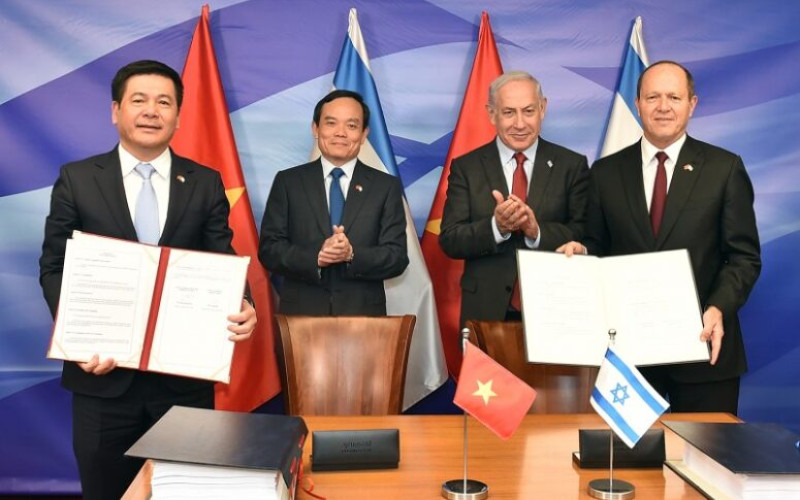

- Free trade agreements: Participation in CPTPP, EVFTA, and RCEP facilitates access to global markets with tariff advantages.

- Rapidly growing industrial zones: Expanding infrastructure in Long An, Bac Ninh, Hai Phong, and Binh Duong.

- Stable FDI inflows: Global giants like Samsung, Foxconn, Lego, LG, and Panasonic continue to expand operations.

Weaknesses

- Shortage of skilled labor: Especially in high-tech industries and automation.

- Underdeveloped infrastructure: Ports and rail systems are inadequate, increasing logistics costs.

- Lack of domestic supporting industries: Heavy reliance on imported components and materials.

- Complex administrative procedures: Lengthy permit processes for construction, environment, fire safety, etc.

Opportunities

- Global supply chain shift from China: Vietnam is a top choice in Asean

- Demand for green and high-tech production: Opens doors for clean energy and smart manufacturing investment.

- New investment incentives: Government reforms target high-tech, electronics, healthcare, and renewable sectors.

- Growing domestic consumption: A young, expanding middle class drives demand for locally produced goods.

Threats

- Geopolitical and tariff risks: Potential for U.S. tariffs if Vietnam is seen as circumventing Chinese exports.

- Regional competition: Indonesia, India, and the Philippines are aggressively attracting FDI.

- Electricity shortages: Northern industrial zones have experienced blackouts, affecting production.

- Digital transformation pressure: SMEs lack capital and skilled staff to adopt Industry 4.0 technologies.

Other Articles

Vietnam’s Free Trade Agreements 2025

26/03/2025

10 Booming Industries in 2030

26/03/2025

-cr-1200x430.jpeg)