Vietnam has emerged as a dynamic player in the global economy, and a key factor in its success has been its strategic engagement in free trade agreements (FTAs). These agreements have opened doors to new markets, reduced trade barriers, and created a fertile ground for businesses seeking growth. This article explores how Vietnam’s FTAs can be your gateway to business expansion and increased profitability.

A Network of Opportunities:

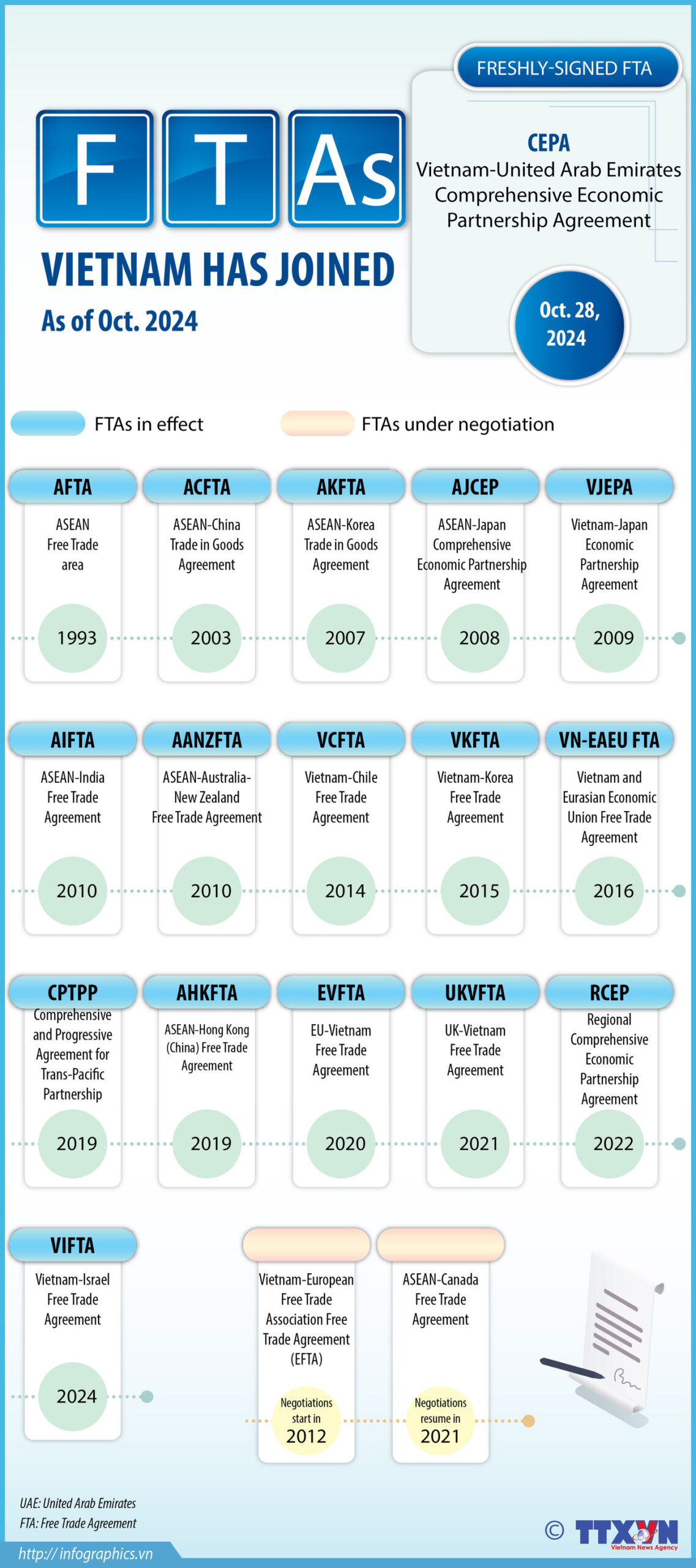

Vietnam has actively pursued FTAs with numerous partners across the globe, creating a vast network of trade opportunities. Key agreements include:

- ASEAN Free Trade Area (AFTA): Facilitates trade within the Association of Southeast Asian Nations, a market of over 650 million people.

- Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP): Links Vietnam with 10 other countries across the Asia-Pacific region, representing a significant portion of global GDP.

- EU-Vietnam Free Trade Agreement (EVFTA): Opens up access to the lucrative European market, offering significant tariff reductions and increased market access.

- Vietnam-Korea Free Trade Agreement (VKFTA): Strengthens economic ties with South Korea, a major investor and trading partner.

These are just a few examples of the many FTAs Vietnam has in place, each offering unique advantages for businesses.

Vietnam’s FTAs

Benefits for Your Business:

- Reduced Tariffs and Duties: FTAs typically lead to the reduction or elimination of tariffs and duties on traded goods, making your products more competitive in foreign markets. This translates to lower costs for businesses and potentially higher profit margins.

- Increased Market Access: FTAs provide preferential access to foreign markets, allowing businesses to expand their customer base and tap into new revenue streams. This can be particularly beneficial for small and medium-sized enterprises (SMEs) looking to scale their operations.

- Streamlined Customs Procedures: FTAs often include provisions for simplifying customs procedures, reducing bureaucracy and making it easier to import and export goods. This saves businesses time and money.

- Improved Investment Climate: FTAs can create a more stable and predictable investment environment, encouraging foreign direct investment (FDI) and fostering business confidence. This can lead to increased opportunities for partnerships and collaborations.

- Access to New Technologies and Expertise: FTAs can facilitate the exchange of technology and expertise between countries, allowing businesses to access new innovations and improve their competitiveness.

How to Leverage Vietnam’s FTAs:

- Understand the Specifics: Each FTA has its own set of rules and regulations. It’s crucial to thoroughly research the specific provisions of the agreements relevant to your industry and target markets.

- Identify Opportunities: Analyze which FTAs offer the best opportunities for your business based on your products or services, target markets, and business goals.

- Seek Expert Advice: Consult with trade experts, lawyers, or government agencies to understand the complexities of FTAs and how to maximize their benefits.

- Build Relationships: Networking and building relationships with potential partners in other countries can be crucial for success in international trade.

- Adapt and Innovate: Be prepared to adapt your products and services to meet the specific requirements of different markets. Innovation and continuous improvement are key to maintaining a competitive edge.

Conclusion:

Vietnam’s network of free trade agreements provides a powerful platform for businesses looking to expand their horizons and achieve sustainable growth. By understanding the benefits and leveraging the opportunities these agreements offer, businesses can unlock their full potential and thrive in the global marketplace. Now is the time to explore how Vietnam’s FTAs can be your gateway to business success.

Contact Invest Talent JSC to discuss your employment needs in Vietnam