Hundreds of billions of dollars in foreign direct investment have become the driving force for Vietnam’s growth over the years, but have also made the domestic economy increasingly dependent on external forces.

From 2 million USD, Vietnam has attracted 524 billion USD of registered FDI capital after 35 years. By the end of 2022, more than 36.000 projects are operating with a total capital of 441 billion USD, 57% disbursed.

Three waves of foreign investment in Vietnam after 35 years

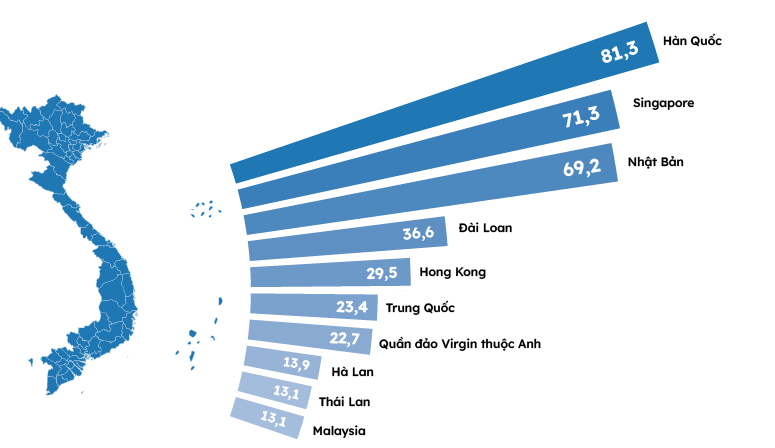

After 35 years, South Korea, Singapore and Japan are the three countries investing the most FDI in Vietnam, while American businesses are outside the top 10. After the event, Vietnam and the US upgraded their diplomatic relations to a strategic partnership. comprehensively in early September, international media expected that Vietnam could welcome the 9th wave of FDI with the main capital flow from the world’s largest economy.

Since the early 2000s, FDI enterprises have gradually become one of the pillars of the economy. Currently, the FDI sector creates 19% of GDP and provides 35% of jobs for workers in the formal sector, although it only accounts for 3% of the number of businesses.

The level of contribution to the economy of the FDI sector compared to the private economy and the state economy

Among the three driving forces of economic growth including investment, consumption and export, FDI is completely leading the last factor. In 1995, the market shares contributing to Vietnamese exports of domestic and foreign enterprises were 73% and 27%, respectively. Nearly 30 years later, this ratio reversed.

Among the 8 most important export products with sales of over 10 billion USD last year, the FDI sector held a dominant position of over 50% of the market share with 6 product groups (except wooden furniture and seafood). In particular, FDI enterprises hold 98-99% of the export value of high-tech products such as computers, electronic products, phones, and components.

Proportion of FDI’s export market share with 8 key product groups

The FDI sector also proves to be more effective than domestic enterprises in many aspects.

In the period 2005-2021, FDI ranked first in growth rate compared to state-owned and private enterprises for 12/17 years. At the same time, although the phenomenon of transfer pricing and loss reporting by many FDI giants is mentioned frequently, in reality this area still has better profitability. From 2010 until now, FDI enterprises have often achieved a profit ratio on revenue better than state-owned enterprises and 2-3 times higher than the private sector.

Based on labor size, 56% of companies with more than 1.000 employees belong to the FDI sector. That means, more than half of large enterprises in Vietnam have foreign direct investment.

But the success of attracting FDI does not only lie in its increasing contribution to GDP, helping Vietnam strengthen international cooperation and enhance its position, according to the assessment of Dr. Phan Huu Thang, former Director of the Department of Foreign Investment. (Ministry of Planning and Investment).

He said that the activities of the FDI sector have indirectly led to many lessons in technology and management experience, helping Vietnamese businesses grow faster. Many companies have developed large projects to serve domestic consumption from real estate, oil and gas to automobiles, information technology and are also reaching out abroad.

However, one of the biggest limitations is the lack of connection between FDI and domestic enterprises, and ineffective technology transfer.

In FDI projects, foreign investors form joint ventures with domestic enterprises only accounts for 13%, the rest are all 100% foreign capital. Another statistic is that in nearly 400 technology transfer contracts of FDI enterprises in the last 5 years, there was no participation of domestic companies. As a result, domestic companies have not been able to follow the “eagle” to take off.

According to Dr. Thang, the reason is that the domestic supporting industry has not developed fast enough, training human resources in high technology and bringing leading Vietnamese enterprises to cooperate with FDI has not been given due attention. “If foreign investors are willing to transfer technology, to whom will they transfer it?”, he said.

The former director cited the story of when Honda opened a motorcycle factory in Vietnam in the 90s, the Japanese corporation surveyed dozens of domestic mechanical companies, mainly state-owned enterprises. However, they could not find partners to cooperate in producing spare parts and components. The factory cannot localize from the beginning, only gradually increasing the rate over time.

Sharing the same opinion, industrial research expert Nguyen Thi Xuan Thuy said that Vietnam has done a good job of attracting a number of projects, but has not proactively taken advantage of all opportunities to learn from foreign investors. The link between FDI and domestic enterprises is still loose. The number of domestic enterprises participating in the supply chain of foreign enterprises is still limited.

In addition, she said that the FDI management process also left behind “painful lessons” such as: the waste discharge incident in Dong Nai in 2010, the marine environmental incident in the Central region in 2016; or many bankrupt FDI factory owners leave Vietnam, leaving workers behind with debts of wages and social insurance…

Despite these limitations, Dr. Phan Huu Thang believes that the process of attracting and managing FDI over the past 35 years should be evaluated in the context that the country almost had to start from zero after a long period of war. When opening up, Vietnam lacked both hard infrastructure and superstructure to manage the market economy, technology, and finance.

“Success is primary, survival is secondary in a process of rapid development,” Dr. Phan Huu Thang concluded.

To avoid repeating inherent limitations, Dr. Thang believes that the authorities need to realize the correct orientation in Resolution of the Politburo 2019 on improving the quality and efficiency of foreign investment cooperation. He emphasized that this policy clearly states the spirit of “cooperation” with FDI instead of simply “attracting”.

“There are opportunities from shifting global capital flows, but Vietnam still has a lot of work to do if it really wants to have a new wave of investment,” the expert said.

About the data:

– Data on foreign investment and exports at the end of 2022 according to the General Statistics Office and the General Department of Customs

– Information about the three waves of FDI is quoted from the study “The third wave of foreign direct investment” by Professor Dr. Nguyen Mai, Chairman of the Association of Foreign Investment Enterprises

Source: Vnexpress.net